Credit cards are prevalently associated with uncontrolled shopping habits, bad debt and financial ruin.

I used to hold the same opinion.

I had vowed never to use a credit card in my life.

Why should I when my debit card worked everywhere and didn't come with the associated risks?

But:

I completely shifted my perspective when I realised the magic of credit cards as a smart financial tool.

In this blog post, I'll talk about how using a credit card can be beneficial in many ways and how to not fall into the dreaded debt trap while using one.

Let's start by understanding:

The types of credit card users

Financial institutions segregate credit card users into two primary buckets — transactors and revolvers.

Transactors use their credit cards like debit or prepaid cards.

They spend money via their credit cards, and when the bill comes, they pay their bill in full before the due date.

And since credit card companies don't impose any interest or additional charges if you pay your bill in full within the due date, transactors essentially use their credit cards at no extra cost.

They pay for what they purchase with their cards — nothing else.

Revolvers are different.

They pay back only a tiny chunk of their monthly bill, known as the minimum due and keep their tab running.

Okay, what's a minimum due?

Credit card companies offer two methods to pay your bills every month:

- Pay in full: Your bill gets cleared, and you start with a clean slate on your next billing cycle.

- Pay only the minimum due: You can pay a small chunk, say 10% of your actual bill and keep your card active for future transactions. The rest of your bill amount gets rolled over to the next billing cycle.

So:

It's like postponing your troubles to the next month. And then the next and onwards.

Who wouldn't want that?

But, here's the thing:

Although paying your minimum due sounds ingenious on paper, it can be devastating in reality.

If you pay only the minimum due amount or anything short of your total bill amount, the rest of your bill that gets carried forward will accrue a severe interest, often at around 16% or more, until you pay it off.

And to add salt to your wound, this interest is often charged daily.

This means you're racking up colossal compound interest charges on your unpaid bill every day you choose to postpone it.

Postpone your bill payment by a month, and that's 30 days of interest to pay, charged daily.

What's worse?

If you develop a habit of paying your minimum due every month, you can quickly rack up thousands or hundreds of thousands of dollars in credit card debt.

Sounds too much?

Here's a statistic to help you understand the gravity of the situation:

Americans pay roughly $120 billion in credit card interest and fees every year. 🤯

That's a whole lot of dough for the credit card companies.

No wonder they spend so much money on marketing their credit cards.

And the situation is similar all around the world.

Millions of people fall prey to the lure of paying only the minimum due because they often spend more than what they can afford.

I had a colleague who invested over ₹80,000 (~$1,000) in cryptocurrency in one month and didn't have enough money left to pay his credit card bill in full.

And, to no surprise, he regretted his decision once he got hit by the massive interest charged on his partially paid bill the next month.

So, what's the deal here?

Your job is to be a transactor and not a revolver.

But then, what's the point of using a credit card in the first place?

Won't using a debit card be better?

Well:

Being a transactor has its benefits

Transactors get the best of both worlds by using their credit cards like debit cards.

No extra fees or interest on their monthly bill.

And loads of rewards and cashback in the form of:

- Reward Points. These can be exchanged for flight tickets, gift vouchers, physical items, and more.

- Discounts. You can get an upfront discount at online shopping websites if your credit card company is running a promotion at the time.

Let's understand each reward type with some examples:

Depending on your credit card, you'll earn reward points or airline miles for every transaction you make.

For example:

American Express gives me 1 reward point for every ₹50 (~$0.6) I spend through my credit card.

So, say I spend ₹4,000 (~$50) using my AMEX card, I'll get back 80 reward points in my account at the end of my billing cycle.

And, I can exchange these accumulated points in my account for physical items, flight tickets, travel accommodations or gift vouchers at various retailers.

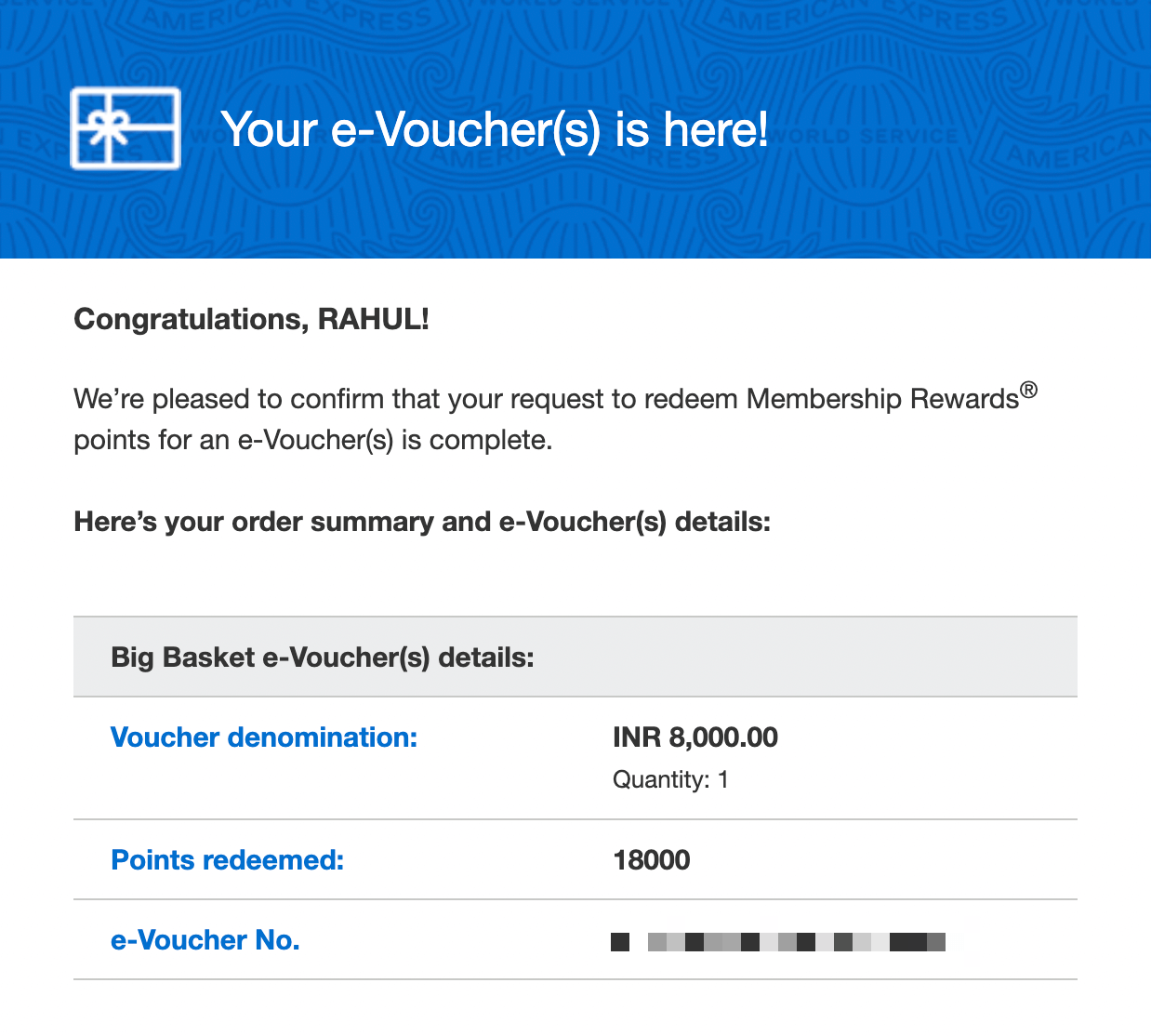

Here's an instance where I redeemed 18,000 reward points for a gift voucher worth ₹8,000 (~$100) for groceries:

For a family of two in India, that's equivalent to a month or more of groceries. Completely free of charge.

And, I didn't have to buy anything specific or spend money on a particular website.

I used my credit card as I would've used my regular debit card.

Anywhere and for anything that I needed.

Between the cards my wife and I have, we've earned back over ₹60,000(~$750) in the last 3–4 years by exchanging rewards points for flights, vouchers and free lounge access at the airport.

Free money or experiences you would otherwise leave on the table using a debit card.

Keeping aside reward points, credit cards (at least in India) offer huge discounts on online shopping from time to time.

For example:

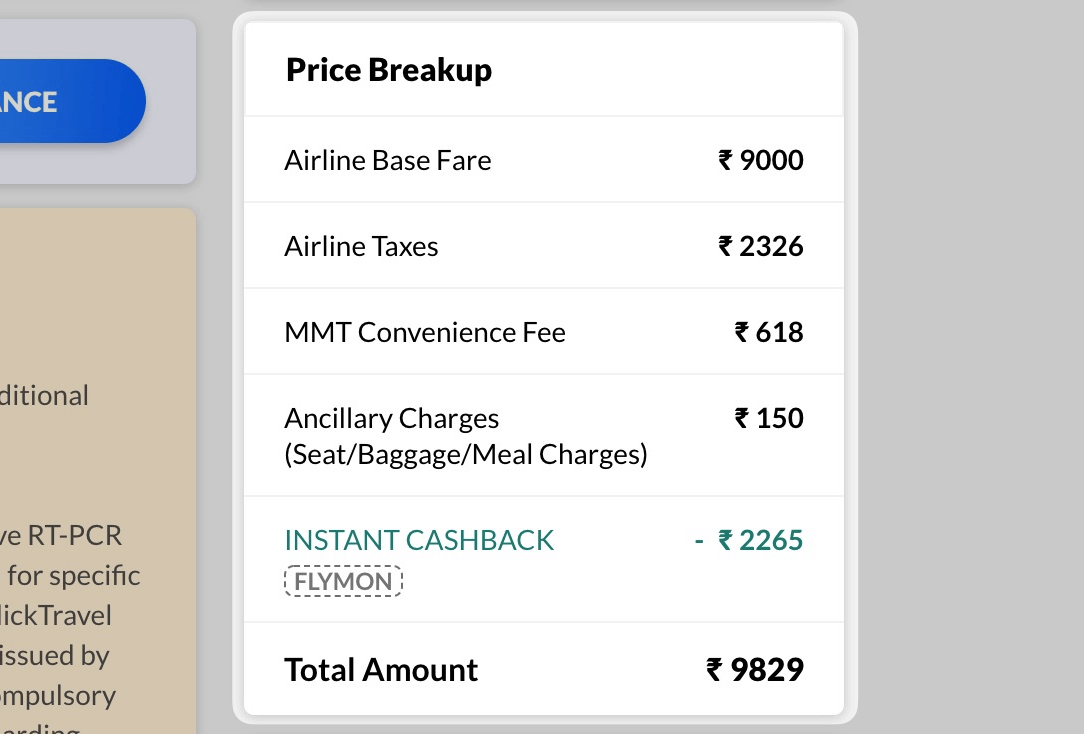

We got a discount of ₹2,265 (~$28) on flight tickets worth around ₹12,094 (~$150) because the travel website was running an offer on a credit card we had.

That's a flat 18% discount on the flight tickets of my choice.

And this was just a single example out of many.

I have saved ₹10,000 (~$125) while buying my MacBook, around ₹6,000 (~$75) while buying my Sony A7 III camera, and more.

All by simply channelling money through our credit cards rather than debit cards.

Also:

We've never paid a dime in interest since we've always paid back our monthly bills in full like a transactor.

To visualise the situation better, imagine using a credit card as a transactor like a game:

There's an endless road filled with potholes along the way and rewards hanging on top of your head.

As a transactor, your job is to jump over the potholes of interest and late fines and collect the rewards along the way.

But that's not where the fun ends.

There are indirect benefits of being a transactor in the form of:

Better borrowing capabilities

The first ever loan I applied for was during my wedding.

It was a small loan, and I had the impression that the process would be a breeze since I had a good and stable monthly paycheque.

In reality, it was nothing short of a sandstorm.

I remember hopping from bank to bank for over a month to get a bank to agree to lend me money.

Why the hassle?

Because I had no existing credit score.

Wait, what's a credit score?

It's a number that financial institutions use to determine how likely you are to pay back the borrowed money.

Your credit score increases as you borrow money and pay it back on time.

Default on a loan payment, and your credit score dives.

And, since I had never borrowed money from any financial institution before, I had no metric in the system that banks could use to gauge my repayment ability.

That horrifying incident of getting rejected by banks for a small loan was the trigger point to building a good credit score for the future.

You never know when you might need to borrow money for a large purchase or health emergency.

Having a good credit score minimises the hassle of the process.

So, how do we build one?

Well, loans are one way.

But:

Credit cards are the most accessible approach.

I'm yet to see a traditional interest-free loan. In comparison, credit cards are just that.

So, I opted for my first credit card in January 2019 and swapped it out with my debit card everywhere.

This switch helped me build an excellent standing with the banks in less than a year by being a good borrower.

And over time, my credit score climbed from an embarrassing 0 to around 850, rated as exceptional by the credit reporting company Experian.

Now:

This score is not just a fancy flex.

With a high credit score like 800+, I'm able to get the following benefits:

- Pre-approved loans. No paperwork is needed. If I opt for one, money gets credited to my account within a minute.

- Lucrative interest rates. Banks offer lower interest rates to lure high-score customers, and I benefit from this scheme with a score like this one.

Here's an example:

When I bought a car in 2020, I wanted to finance it partly in saved cash and partly via an automobile loan.

And, unlike my previous disappointing experience of chasing banks for a loan, it was as smooth as it gets this time.

The process took around 5–10 minutes at the car dealership, and I had my loan approved and disbursed in another few minutes.

Also:

With a good credit score, I got a slightly lower interest rate on my loan, which made the deal even sweeter.

But, here's the thing:

Building a good credit score is not only about making full payments in time.

It depends on multiple factors, such as how much you borrow at a time, how long your credit history is, and more.

So, here's a technique that I use to maintain a healthy credit score:

I split my purchases into multiple credit cards.

Each credit card is a separate account with its individual credit availability.

By distributing my monthly purchases into two or more credit cards, I can keep the credit usage or amount borrowed on a single credit account low.

Here's an example:

Instead of borrowing ₹80,000 on a credit limit of ₹100,000, I can split my spending into multiple cards, which might have an aggregated credit limit of ₹400,000.

This keeps what banks call a credit utilisation ratio low on a single credit account and accounts for a healthy credit score.

Similarly, credit age is a factor in calculating your credit score.

So:

Don't expect your credit score to climb to the top within a few months of getting and using a credit card.

Like good wine, let your credit score age well with time.

Now, here's a word of caution:

All these rewards and benefits are fantastic.

But, they go straight out the window if you start:

Being reckless with your credit cards

One of the first thoughts that come to mind after getting a credit card is suddenly, you have access to a shit ton of money that is crying to be spent.

Your monthly take-home income seems no longer a constraint on your wishes since you can pay for anything via your shiny new credit card.

And:

Numerous movies reaffirm this thought by glamorising spending money via credit cards like there's no tomorrow.

But:

If you follow this path of extravagant spending because you have a credit card with a high credit limit, it only leads to a downfall.

And no amount of rewards or benefits is worth this hassle.

So:

The first rule of using credit cards is this:

Never spend money you can't pay up when the bill comes.

Therefore, as we discussed in the earlier sections of this blog post, make it a habit to use your credit card like a debit card.

Only spend as much as you can afford to pay your bill in full every month.

Be a transactor, not a revolver, remember?

Leverage this fantastic financial instrument by following some:

Good credit card etiquette

- Don't spend more than you can afford. Credit cards don't mean access to unlimited money. You still have to pay back every penny you borrow. Spend only what you can afford to pay back in the next bill.

- Always pay your bills in full. Paying the minimum due on your bill is not an ingenious money hack. It's a ticket to a bottomless pit. Pay back everything you borrowed when the bill comes. If you already have some outstanding debt on your credit accounts, aim to clear them as soon as possible.

- Use your reward points. Reward points expire after a year or so. Regularly redeem them to make sure you're not wasting free money.

- Don't max out your credit cards. Even if you can pay back the entire amount, a maxed-out credit card projects a bad borrower image to credit agencies and pulls down your credit score.

- Be aware of sneaky fees. Not all credit cards are good. Some will charge you hidden annual charges or other fees. Make sure you read a credit card's fees list before you get one. Aim to opt for cards that waive your yearly membership fees if you spend X amount of money through your credit cards in a year.

- Opt out of an overdraft facility. Banks often offer overdraft protection where you can spend more money than what you have available as your credit limit. But, as always, this comes with a hefty fee that the banks conveniently forget to mention. Make sure you don't have an overdraft facility on your card, so you don't accidentally exceed your credit limit.

- Don't withdraw cash using your credit cards. Banks usually charge a princely sum if you use your credit card to withdraw money from an ATM. For cash withdrawal, stick to your debit cards.

- Get a card that aligns with your goals. Love to travel? Opt for a card that rewards you with airline miles or free hotel stays. Prefer fine experiences? Pick a card that gets you free access to exclusive restaurants and other experiences for free.

- Limit yourself to 2–3 cards at a time. Each credit card comes with a separate billing cycle which can be a hassle to manage if you own too many cards. Keep up to two or three active cards simultaneously and close any inactive credit account for easy maintenance.

With some discipline and good habits, you can use credit cards to your advantage rather than being a puppet of the big banks.

Credit cards are not evil. You have to be smart while using one.

You don't want to get trapped under a snowball of bad debt chasing reward points.