Tracking expenses has been one of the most constructive habits I've built over the years.

It has, on many occasions, helped me keep my spending in check and audit past expenses for accountability.

Now:

When we speak about tracking expenses, the most common image that pops into our heads is crunching numbers on a spreadsheet and running complex functions.

But that's not how I do it.

The process I use is relatively simple, takes two minutes, and only depends on making it a regular habit.

In this blog post, I'll talk about why tracking expenses manually is an excellent habit and how I make the process less tedious.

Let's start with:

Why track expenses manually

Why would someone manually track their expenses in this age of automation and seamless 3rd-party connectivity?

I was in the same boat when I started tracking my daily expenses.

At the time, Android apps could read texts from banks to credit and debit transactions into my local records without supervision.

This made tracking automated and one less thing to worry about.

However, it also made me ignorant of my financial situation.

I was tracking my expenses for sure, but I was still blind to how I was spending my money and how much I had left in my accounts.

With tracking automated, I barely opened the app to see the state of my finances.

And within a few months, I completely forgot that I was even tracking my expenses.

Also:

Automated tracking works on guesswork.

The apps can guess which category your transaction falls into, the payee name, and the used bank account.

But they can't identify what the purchase was.

This is a problem because although I was tracking everything, locating a specific transaction when needed took a lot of work.

You can only deduce so much from the payee's name, amount and category.

And:

This is where manually tracking expenses helps.

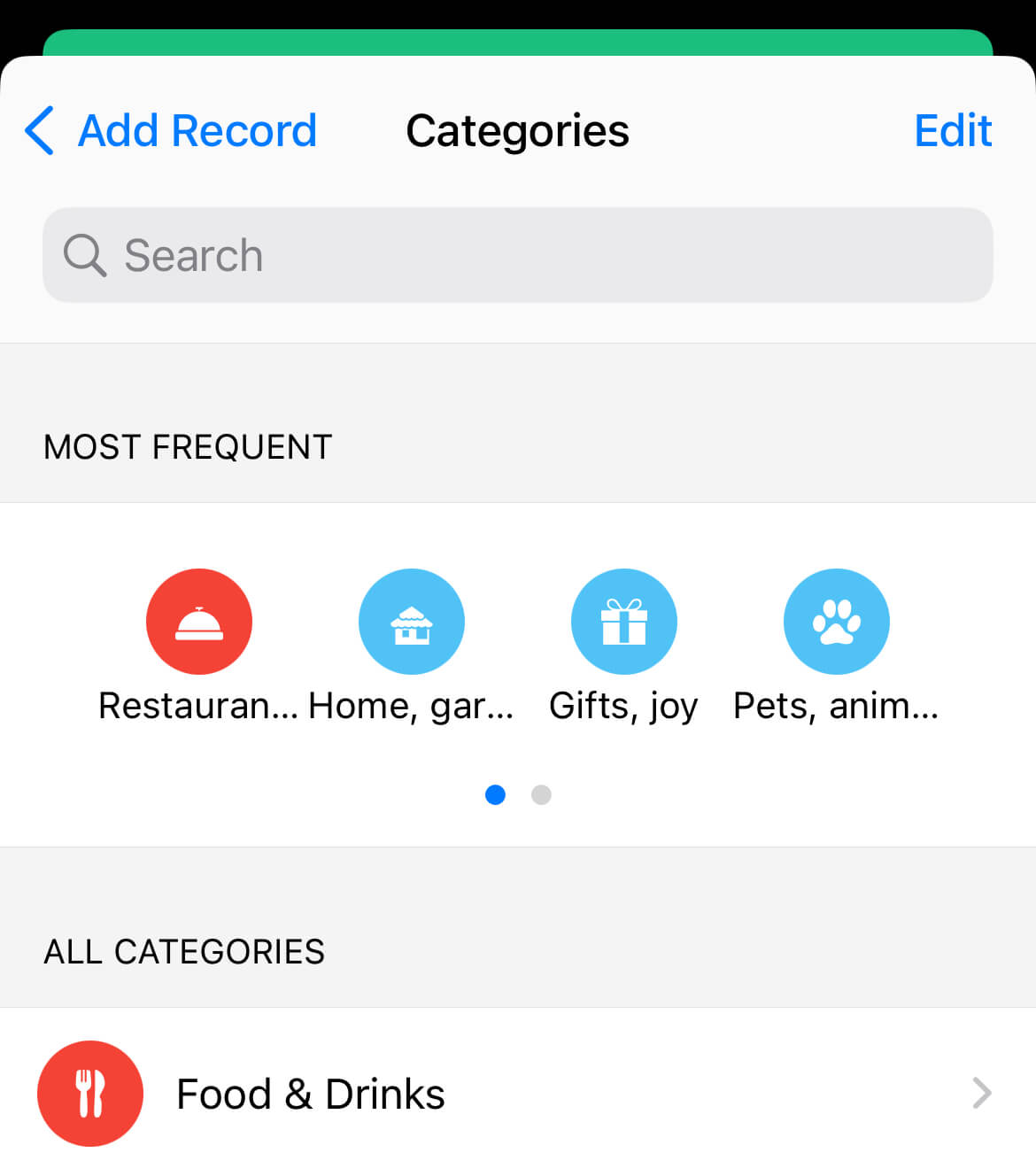

Manually inputting each expense on an expense tracker app lets me choose the particular category for each payment and not rely on any AI or automated sorting like this:

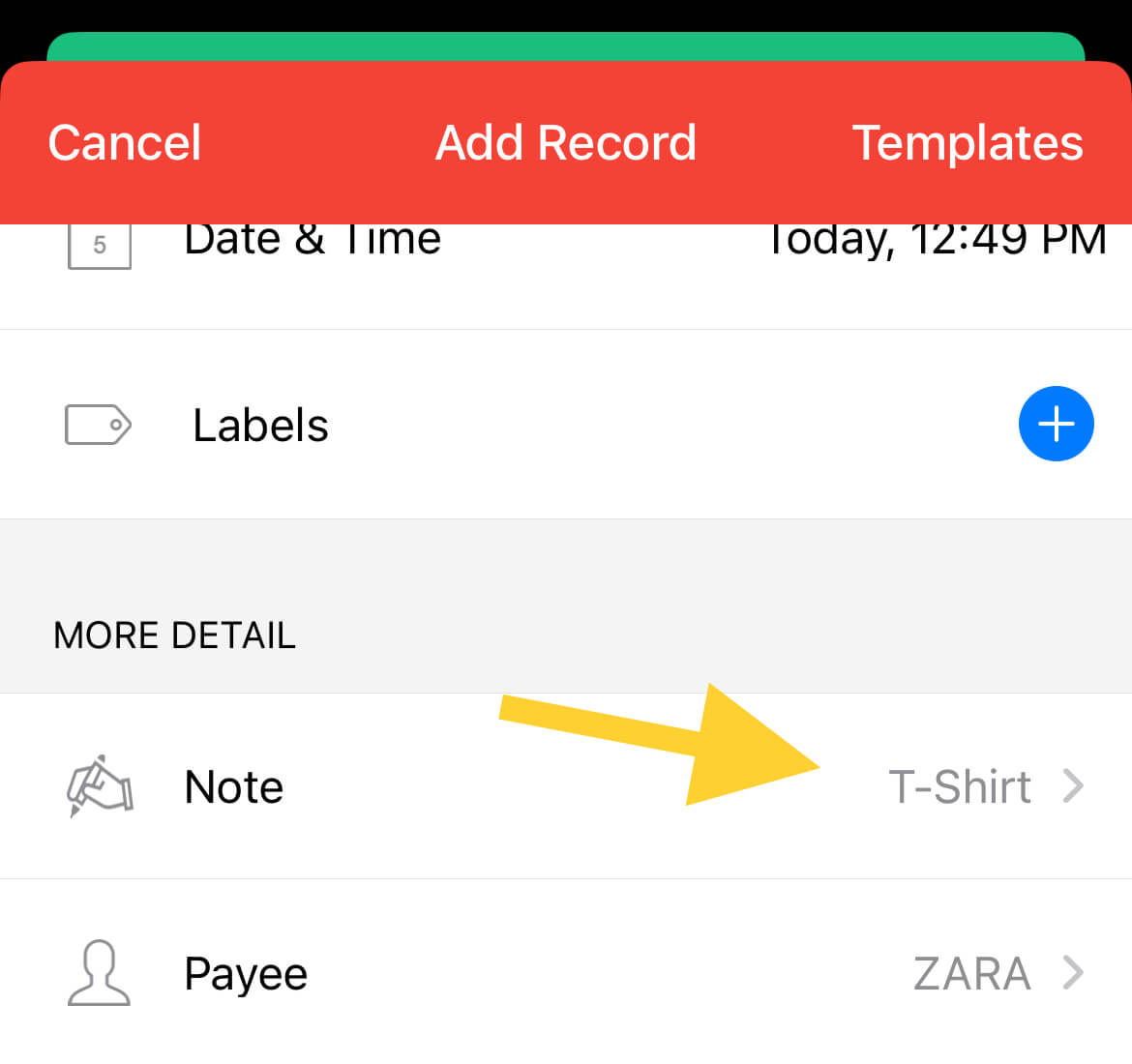

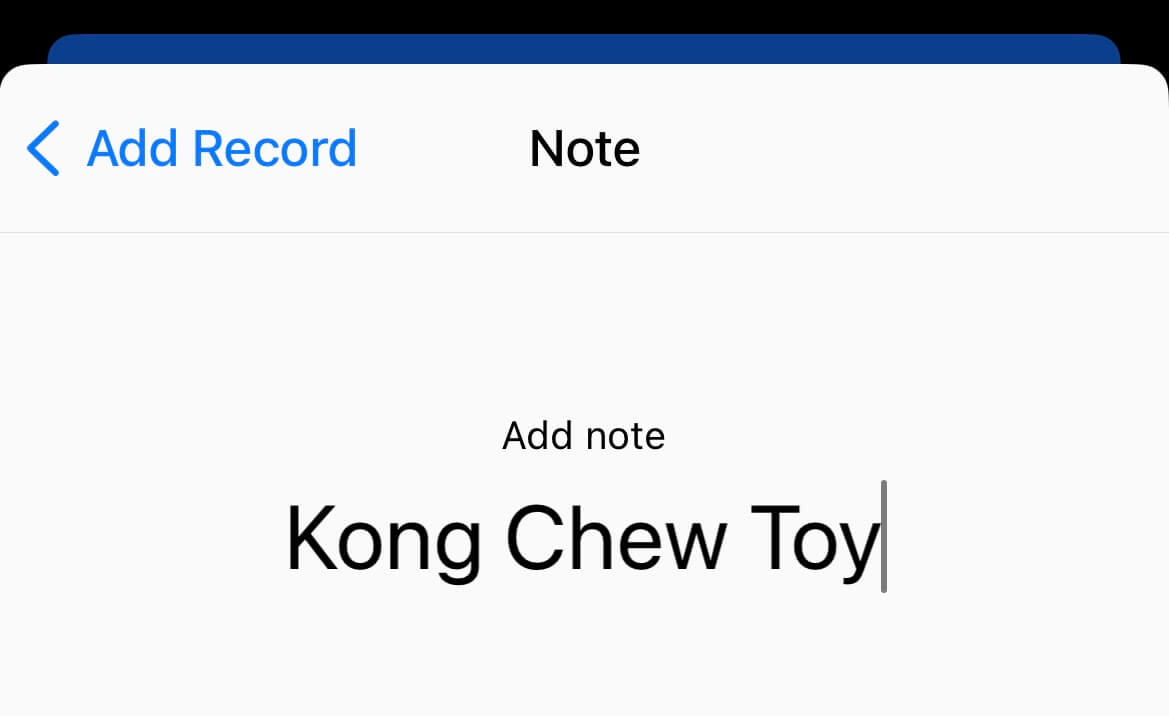

And, every time I add an expense, I can jot down a note to help me identify what the payment was for, like this:

Now, although these might seem like extra information and possibly fluff, these bits of knowledge help me track down any past expenses with a quick search.

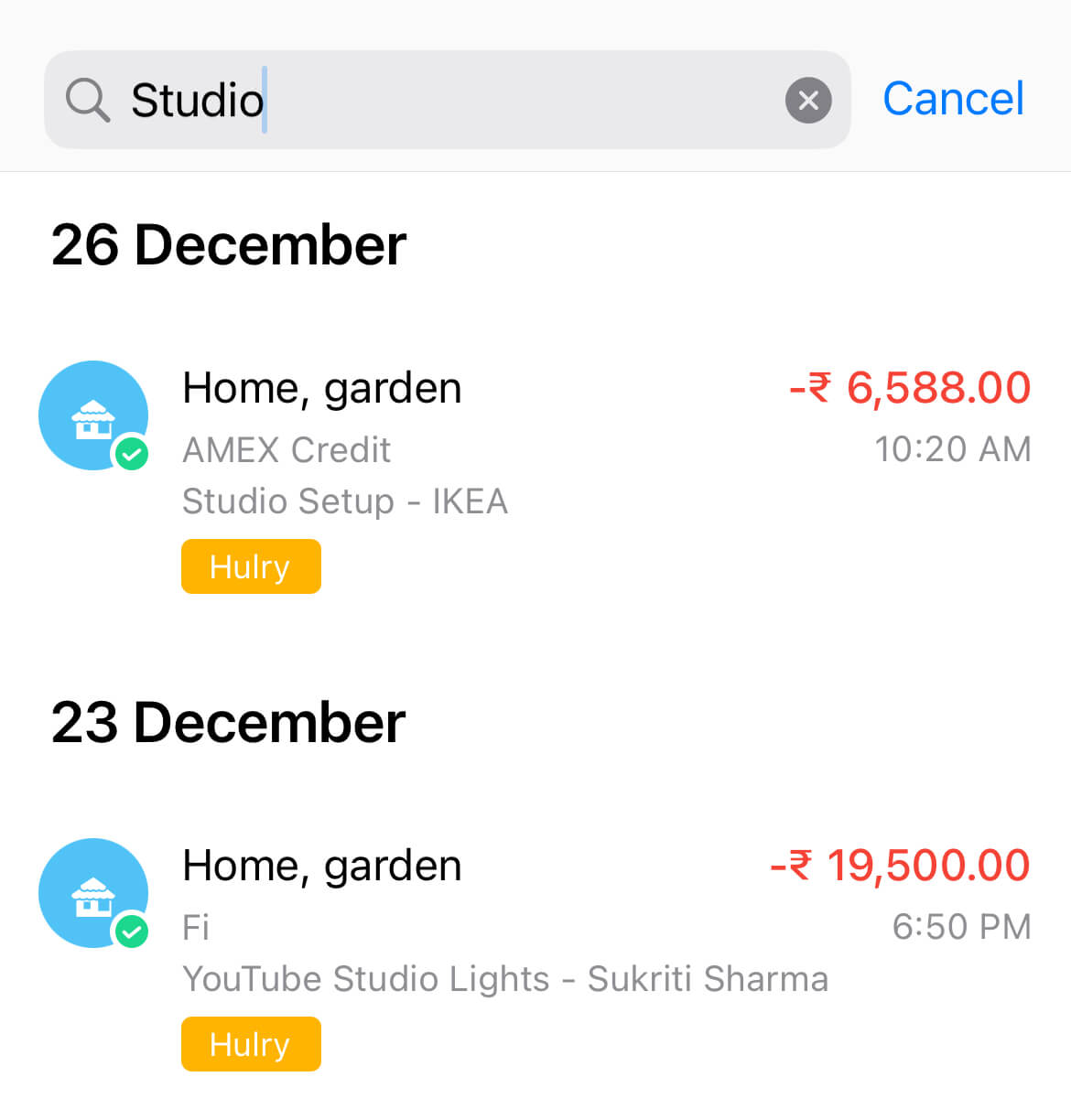

For example, I can swiftly figure out how much money I spent on buying studio lights for my YouTube channel by searching my notes like this:

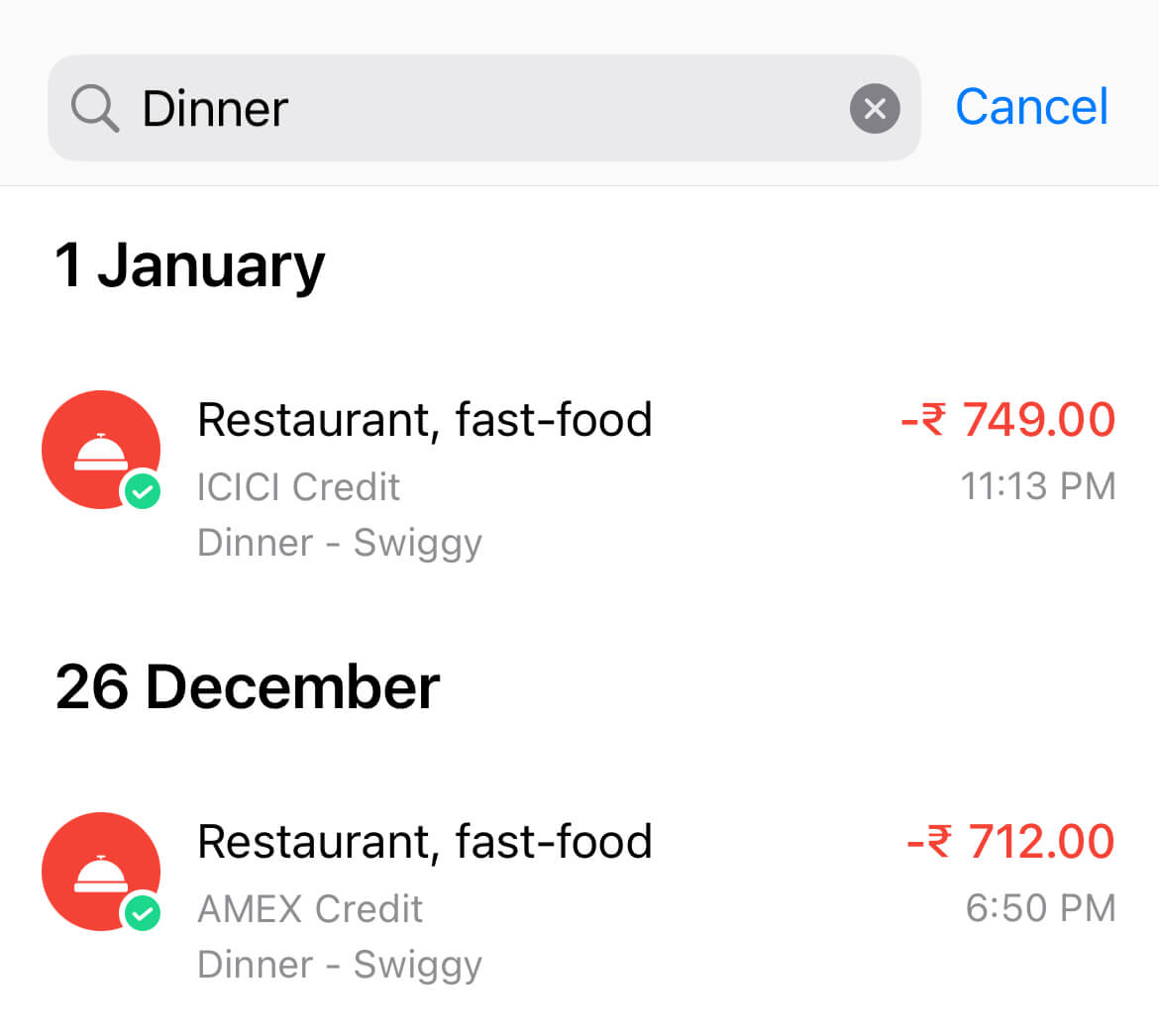

Or, how frequently did I order dinner:

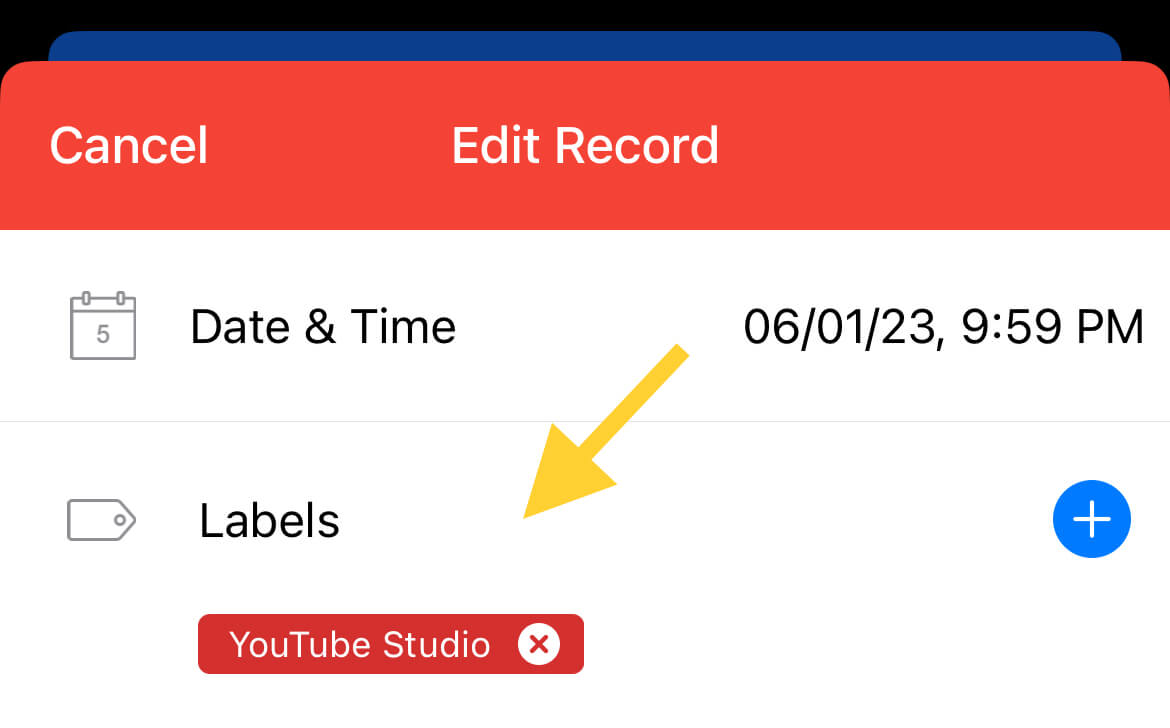

We can also take it further by using labels to group expenses.

Continuing on the above example, if I want to find the total cost of my YouTube studio set-up, I can easily do it by adding labels to the relevant expenses:

And then, I can use the search functionality to search for all expenses tagged with the label YouTube Studio.

This will give me a bird's eye view of all my purchases, and I can figure out my total expenditure on the set-up.

Manual tracking lets you organise your expenses better.

Now:

Apart from better organisation, a side benefit of tracking manually is staying in the loop with my income and expenses.

Recording each expense makes me more mindful of my spending habits.

As I open the app to record any expense, I get a quick view of my current bank and credit balances, giving me a rough idea of my remaining safe spending quota for the month.

Also, since I use credit cards, I can check my current card balances to see if I'm overspending somewhere.

Manual tracking is a habit you need to form, and once you get in the swing of it, it's easy to fall in love with the process.

So:

Now that we've discussed the benefits of tracking your expenses, the next question is, how do you track them?

While you can use a digital spreadsheet or a notebook to track your expenses, here's how I do it:

Tracking expenses with the Wallet app

I've been using the Wallet app to diligently track my daily expenses since my wife introduced it to me in 2018, and it has been a complete game-changer.

Now:

This app does have an automated bank sync that can record your expenses without supervision.

But, given the merits of manually recording each expense, I've followed this route since the beginning.

And this is how I do it:

Every time I make a transaction, I immediately open the Wallet app and record the transaction like this:

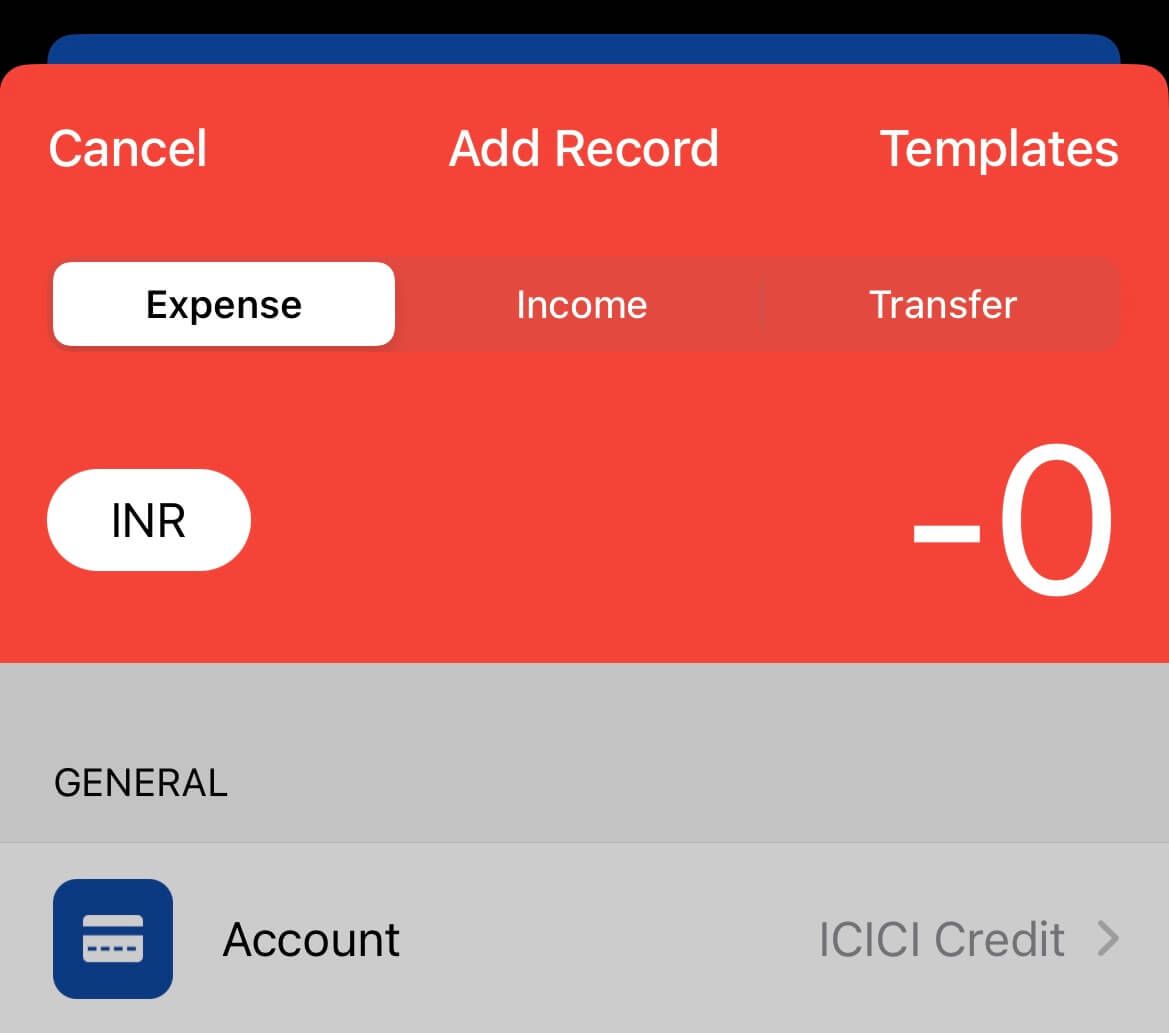

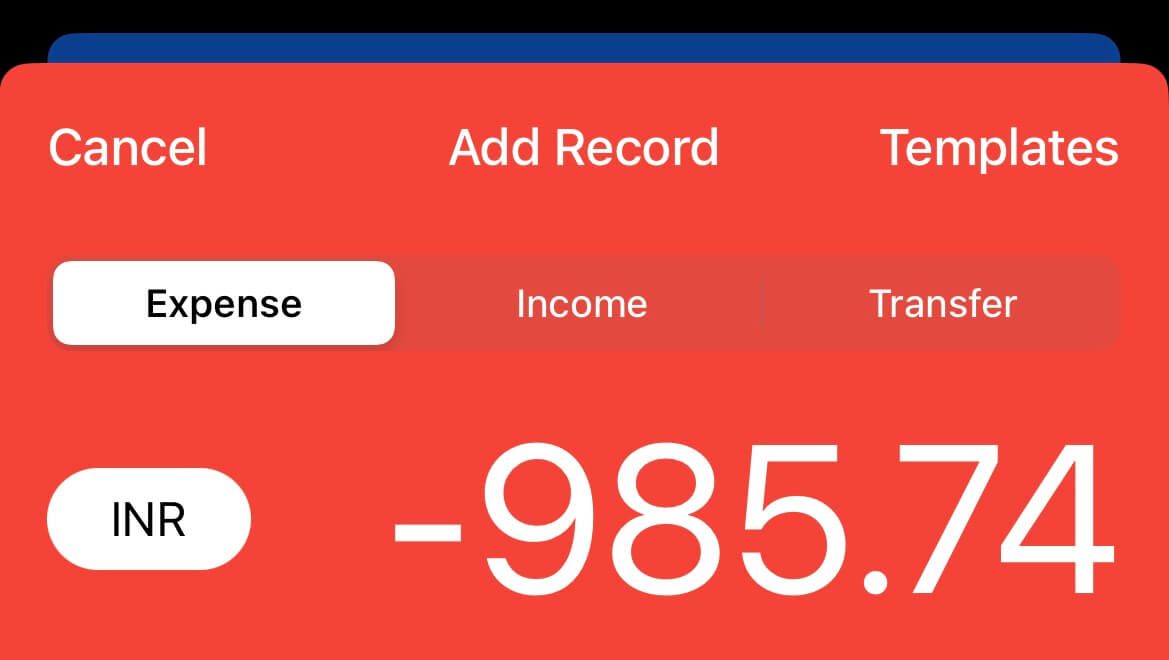

Choose a bank or credit card account → Tap on Record to open this screen:

On this screen, record the transaction amount and choose the transaction type — income, expense or transfer.

This is how I choose the appropriate transaction type:

- Income: Salary or other forms of income from the business

- Expense: Regular spending like buying food, groceries, paying bills, etc.

- Transfer: Moving money from one account to another, sending money to family members, etc.

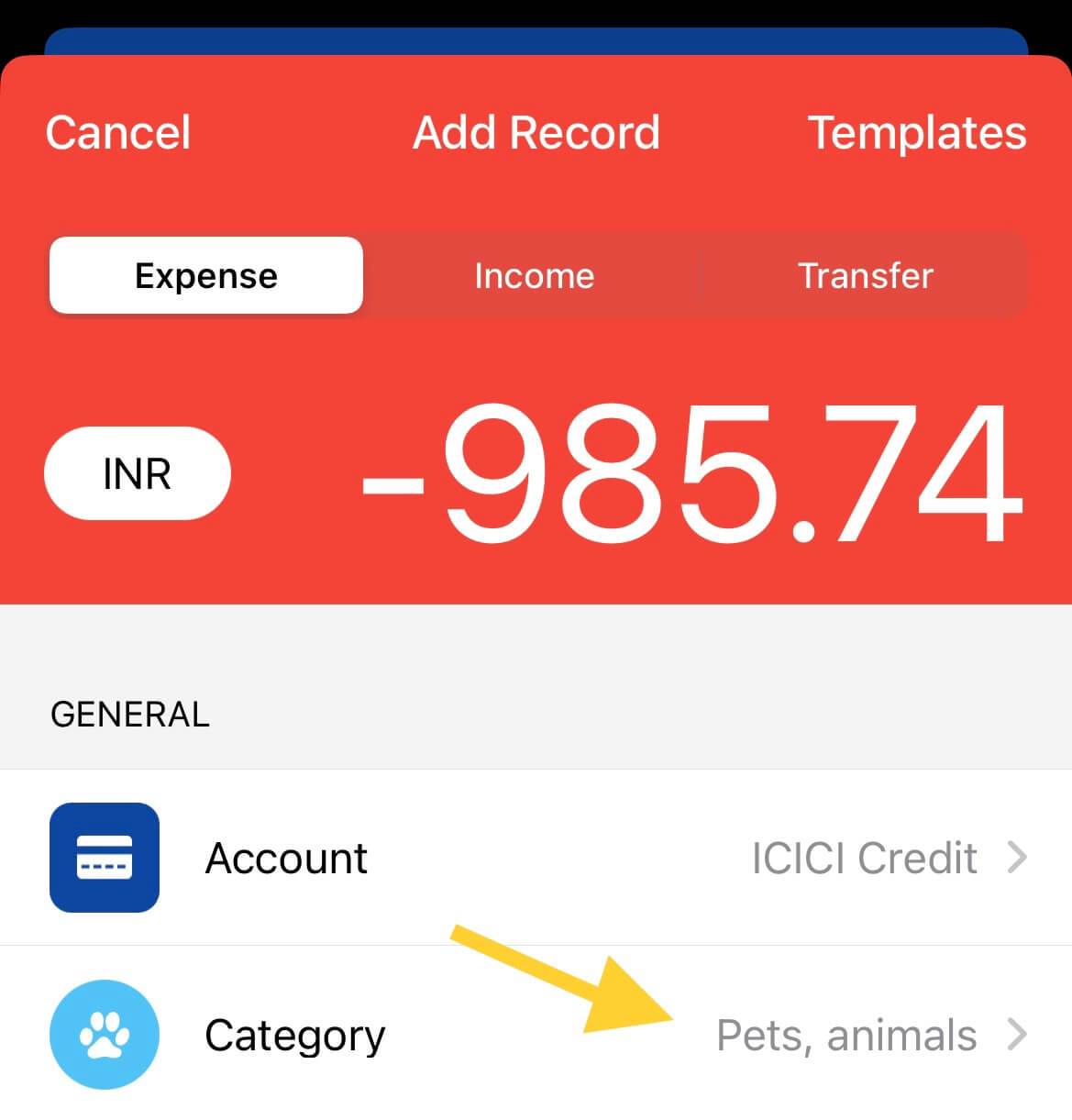

Moving on, I choose the closest category I can find for this transaction:

Then, I wrap up the record by adding a note that'll help me identify what this transaction is for, and write the payee name:

And that's it.

Tapping the save button records the transaction in a secure, synced and searchable database for later reference and auditing.

Now:

The whole process may seem too cumbersome and tedious, but once you do it regularly for a week, it becomes second nature and takes less than 2 minutes per transaction.

If you'd like to batch these actions, instead of recording each transaction as and when it happens, you can reconcile everything at the end of each day.

In the evening, take 15–20 mins and record every expense you made on that day on the app.

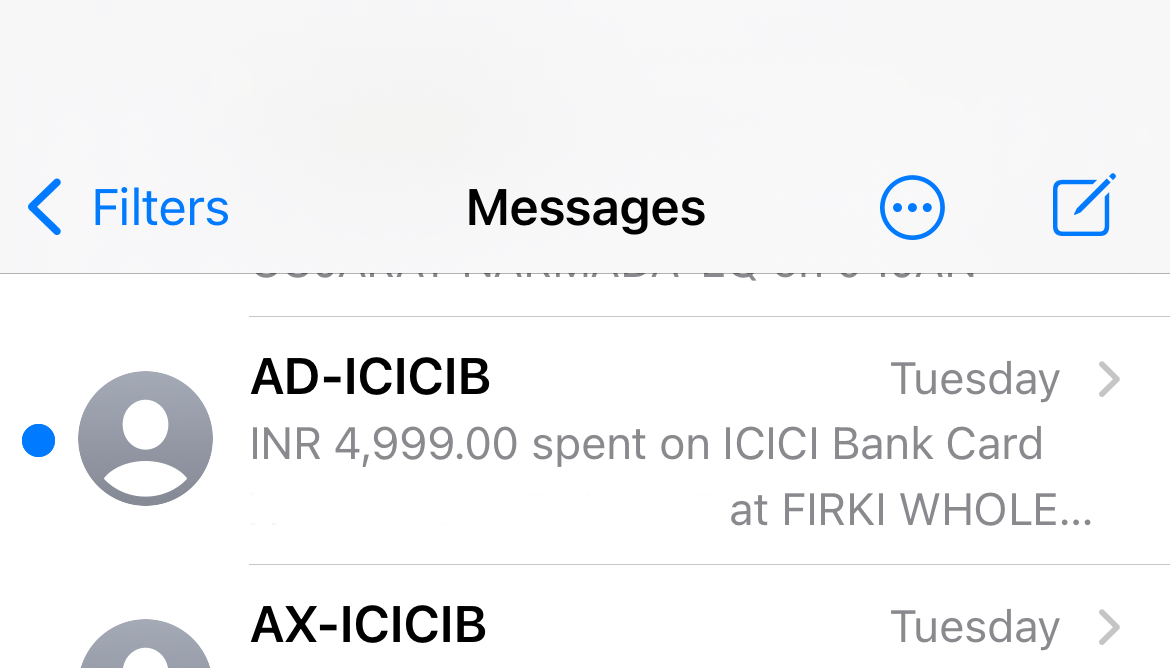

A simple trick to ensure you're not missing out on any transaction is to keep texts or other messages from your bank for each transaction unread, like this:

So, you can go through your unread messages and jot down any transaction you encounter at the end of the day.

I aim to record everything as and when it happens because it reduces the burden of adding too many transactions at once, but when I miss adding them at the moment, I use the above trick to add all unrecorded expenses before bedtime.

Choose whatever approach works best for you.

Now:

Tracking recurring expenses daily or monthly can be a hassle because you're adding similar details repeatedly.

For example:

A rent payment to your landlord would contain the same information.

Why bother filling out everything over and over again?

Thankfully, the Wallet app has an incredible feature called Planned Payments that makes this job a walk in the park.

And here's how to:

Create planned payments for recurring transactions

Transactions such as salary credit, monthly maintenance fees, or app subscriptions usually don't have any variable other than the amount.

And there are times when even the amount is the same as the last transaction.

For example:

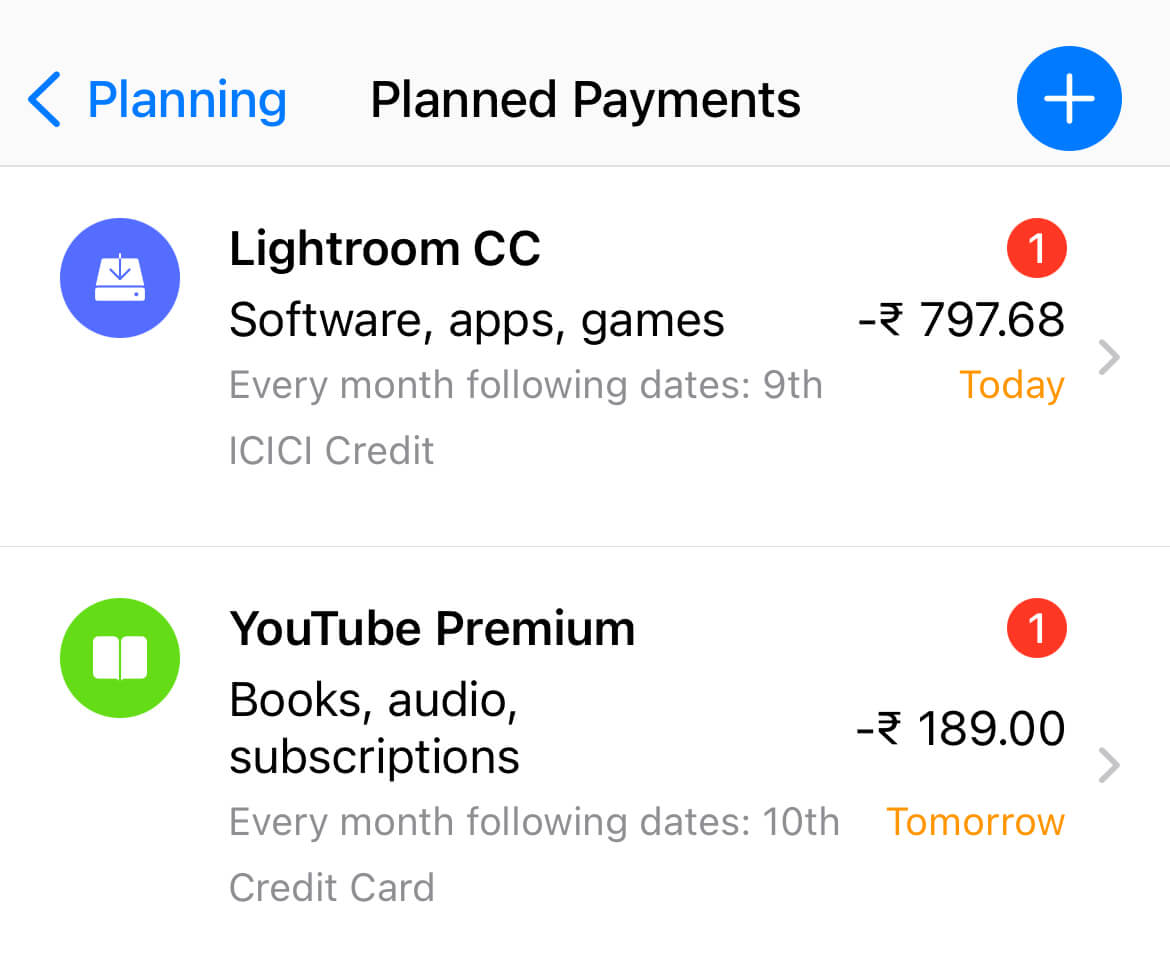

A YouTube Premium subscription would have the same amount, note, payee name and category every month the expense gets recorded.

So:

Typing these expense data every month is a waste of time and effort.

To make this job less tedious, I create planned payments in the wallet app like this:

You can see I have a ton of planned payments that are recurring monthly expenses or income with the same information and classification.

And with this setup, I can record recurring transactions with minimum or no intervention.

Here's how you can create a planned payment in the Wallet app:

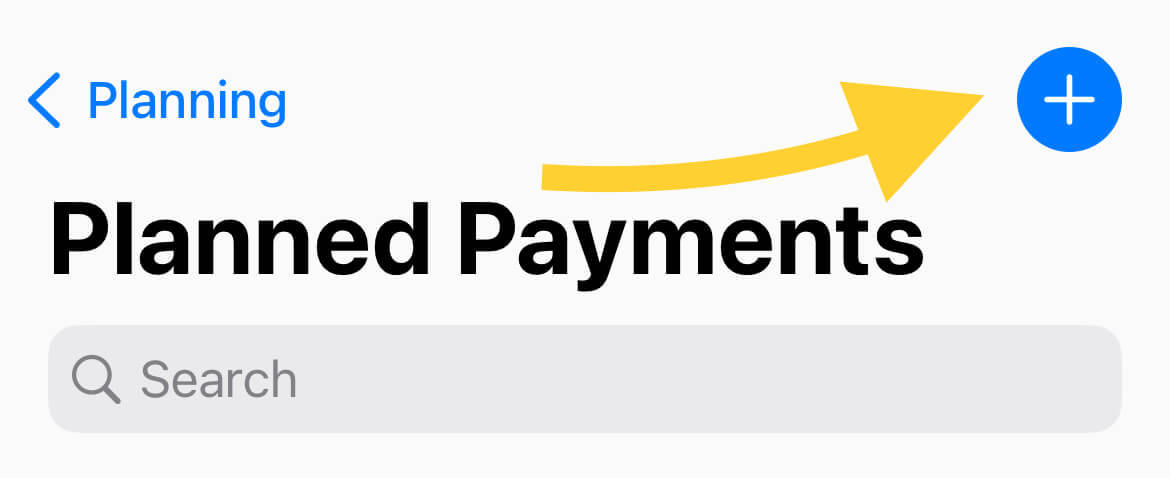

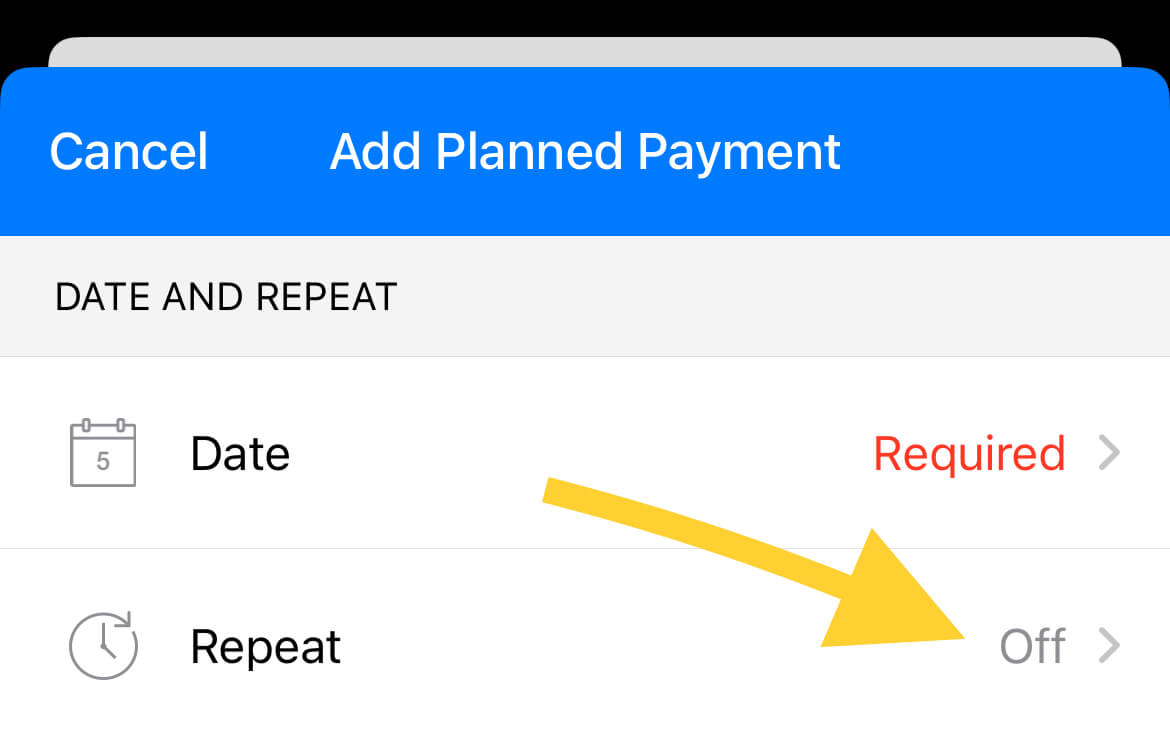

Go to Planning → Tap on Planned Payments → Tap on +

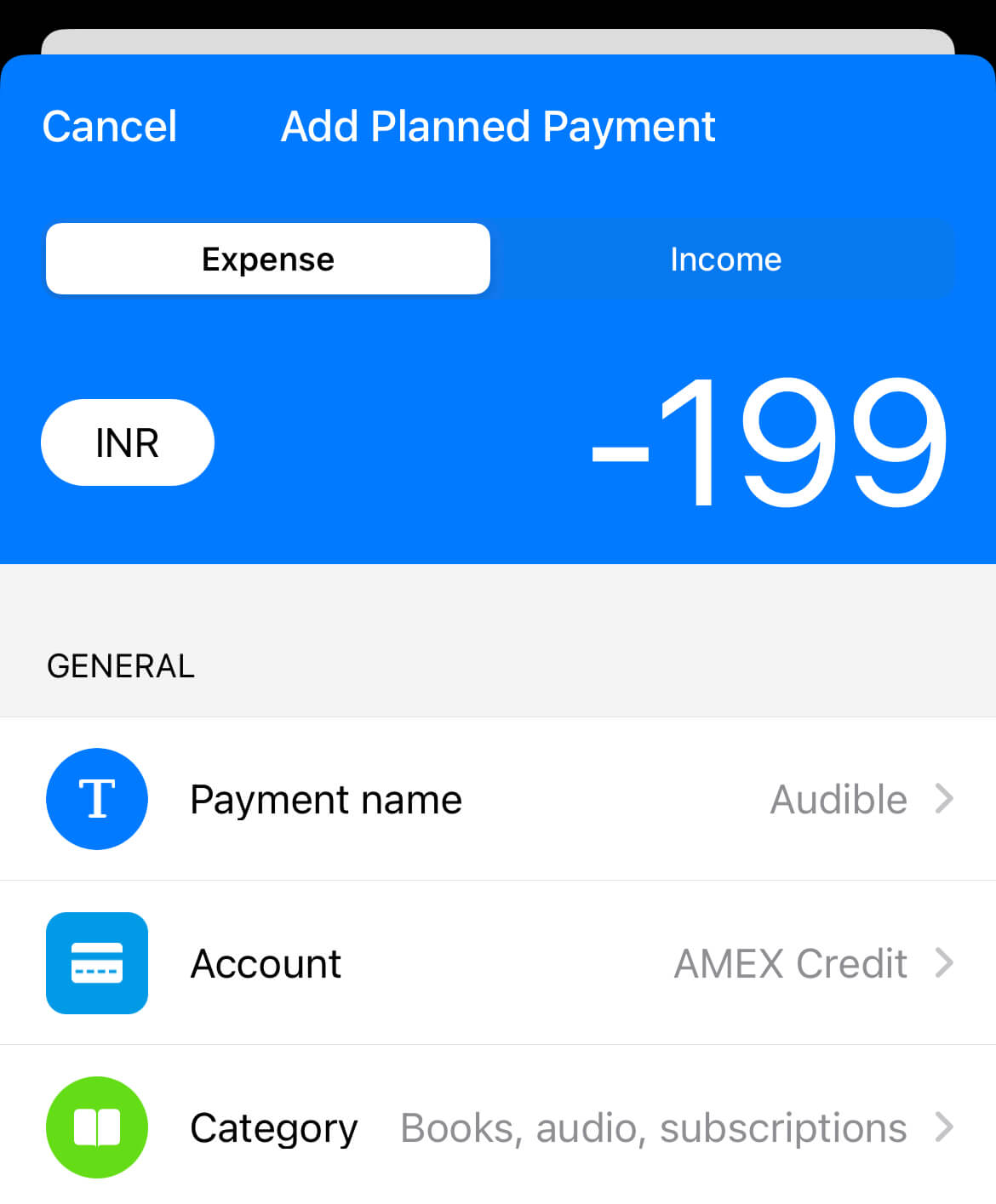

Choose the account and transaction type, income or expense and fill out the amount, name, category, start date, payee name and note fields:

Now:

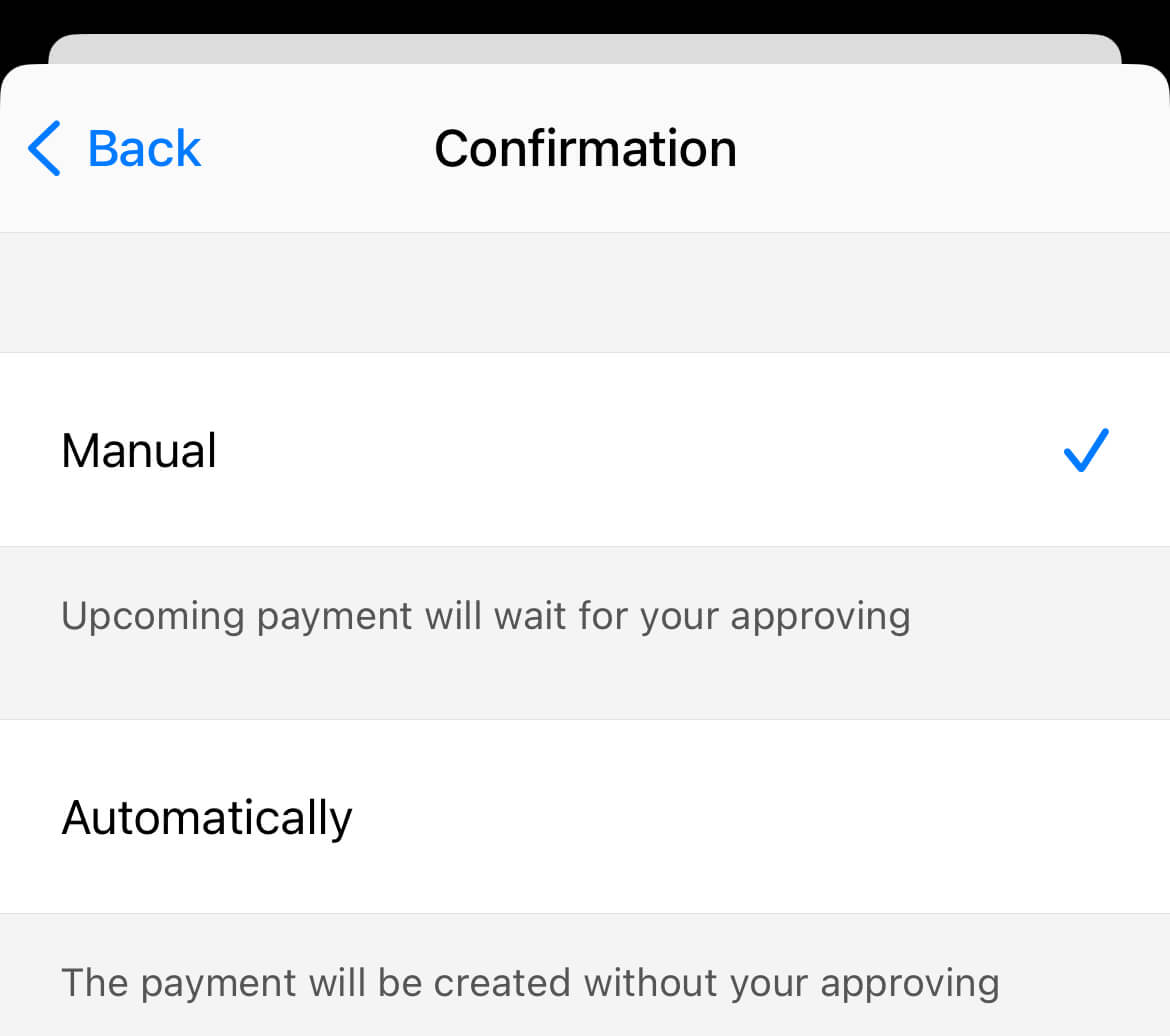

Before you save this planned payment, tap on the Confirmation field to reveal these options:

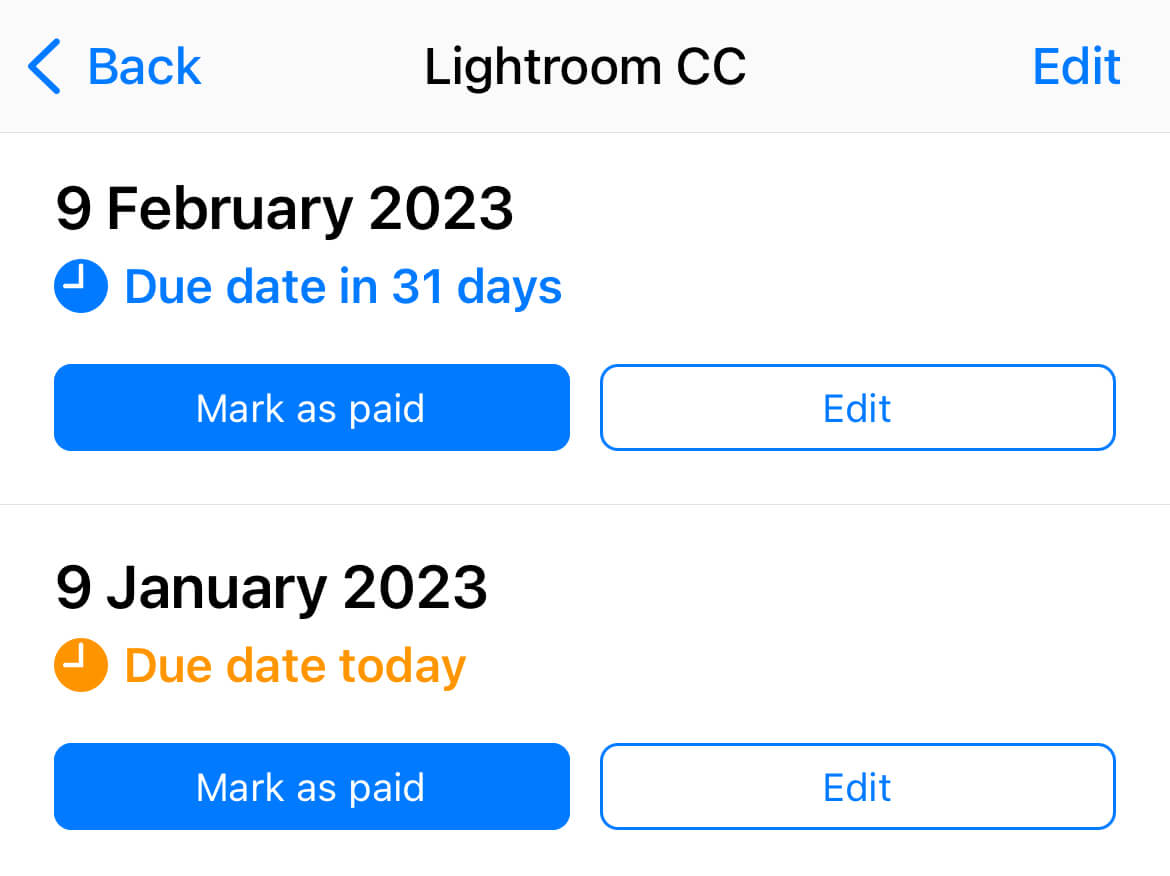

With Manual confirmation, you'll get an approval request before the payment gets recorded into your account, like this:

This is helpful when you don't know the transaction amount and want to edit it before recording it.

I set this option for my salary payments and subscriptions that get charged in foreign currency because I can't tell the exact amount upfront.

When approving this payment record, I can quickly alter the amount and save the transaction in a couple of taps.

However, for subscriptions and other payments where I know the exact amount I'll be charged in future, like a savings transaction, or subscriptions charged in Indian Rupees, I default to the Automatic mode.

This means I don't have to intervene, and the transactions will get recorded every month, week or whatever frequency I've chosen for this payment.

Talking about frequency, a planned payment won't be repeated by default.

You can set it to repeat by tapping the Repeat field and choosing your desired frequency over here:

Now:

Planned payments are helpful when you have predictable recurring expenses or income.

But what about ad-hoc expenses like ordering food or buying groceries with more or less the same information on every transaction but varying amounts and notes?

That's where:

Templates can speed up your workflow

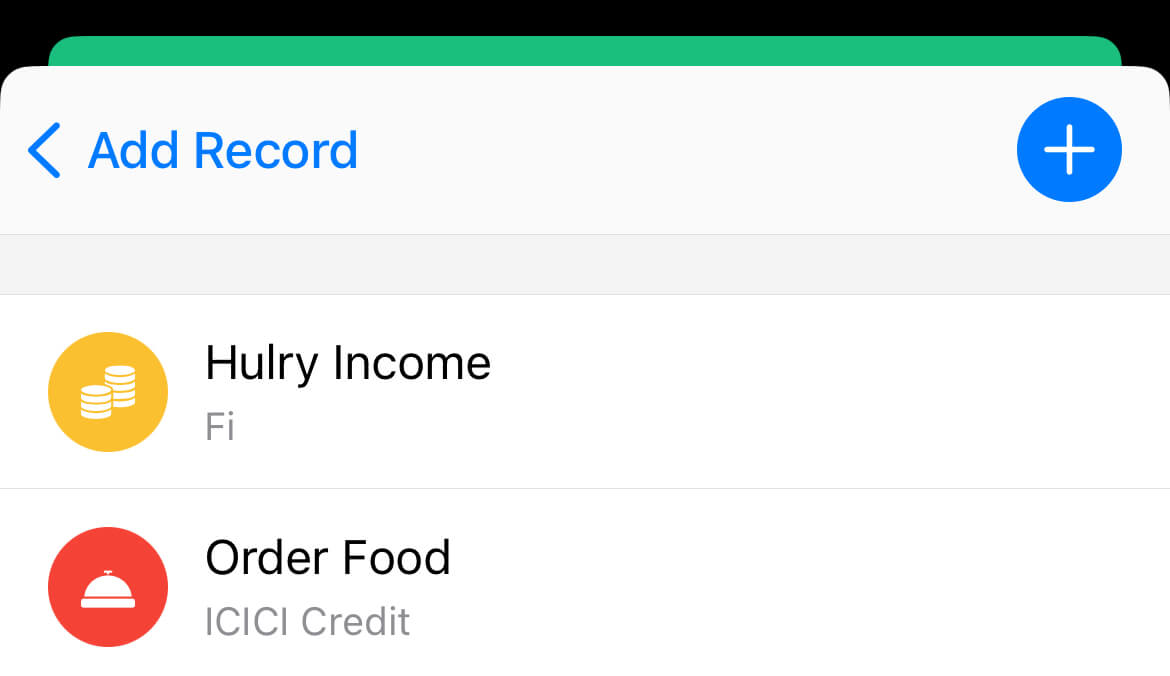

I have two templates created on the Wallet app:

Both of these are recurring transactions, but they aren't scheduled.

I can't predict when I will order food next and, similarly, when I will receive a payment from any sale of the Hulry products.

So:

To make recording these transactions less a chore, I've created templates that help me populate the known data like payee name, account and category while adding a transaction in the app.

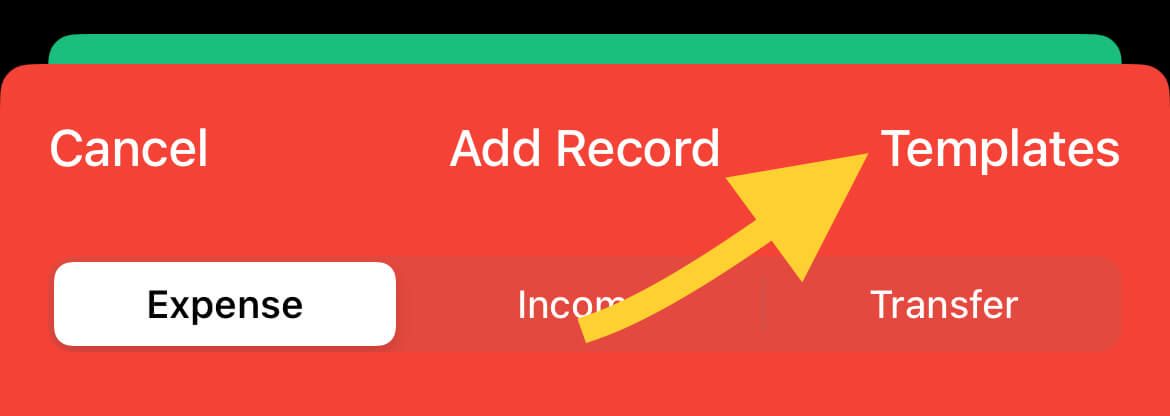

While adding a transaction, there's an option to choose templates like this:

And on choosing a template, the static data I've preset in the template gets populated on the transaction page, saving me some time and effort.

I can add the exact amount, write a transaction note, and hit save.

Easy, isn't it?

So:

How do you create a template in the Wallet app?

Here's how:

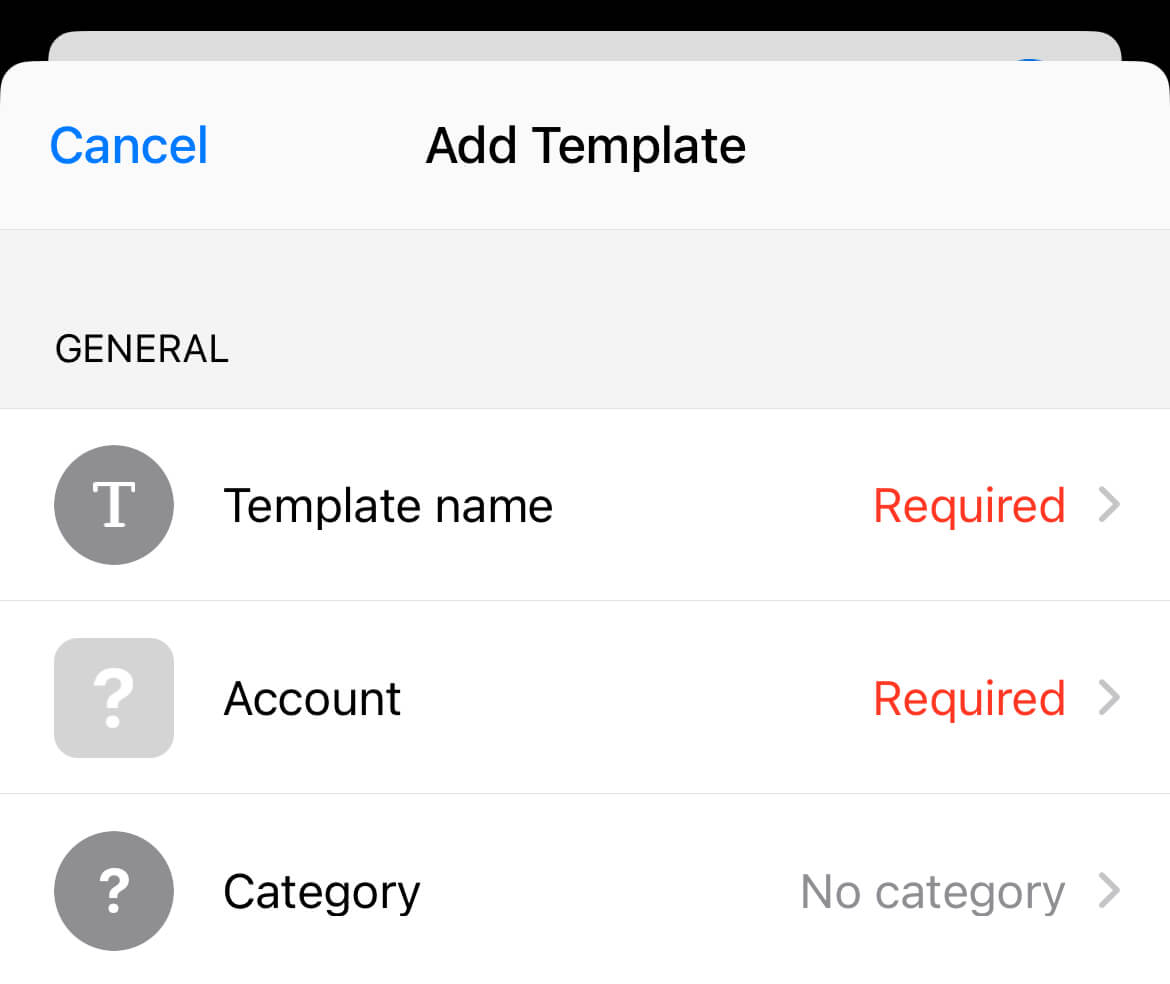

Tap on the + button on the Templates screen to reveal a form like this:

Give the template a name, pre-fill whatever information you can, and leave out the ones you can't predict right now.

Save the template, and you're done.

The next time you record an expense, you'll find your newly saved template in the templates list, ready to use.

Now:

All these techniques and workflows are only good if you're diligently recording your daily transactions.

And for that, here are a couple of pointers that'll help you:

Make expense tracking a ritual

For any system to work, you have to make it an everyday ritual.

This one's no different.

And the easiest way to build a habit out of this process is to immediately note down a transaction as and when they happen, as I do.

It takes two extra mins of work but ensures that you're tracking every expense or income and not missing anything by relying on your memory at the end of the day.

Also:

Adding transactions in bulk feels more tedious and a chore you'd rather avoid when you're exhausted at the end of the day.

So, start with this routine:

Take a few minutes to note the transaction in your expense tracker app whenever you buy something or pay someone.

I use the Wallet app, but you can use any app that works best for you.

Here's a simpler alternate option — Dime.

You may have to remember and do this practice for a week deliberately, but after that, it'll become an unconscious habit.

I don't even have to remember to note an expense.

Every time I spend money, the following action is usually to note down the expense.

But here's the thing:

We're not machines, and life's random.

You might not always be in a situation where you can quickly jot down each payment as soon as you make one.

For example:

You're rushing to catch the morning train to work; at that moment, your priority is buying the ticket and going to the assigned platform, not standing near the ticket counter and noting your expense.

In such cases, you can either rely on your memory to note down all unrecorded expenses at the end of each day.

Or, if you're doing digital transactions, you can keep your transaction text from the bank unread so that you can remember to jot any pending transactions in the app.

With that said, it's natural to miss adding a transaction or two from time to time.

Don't beat yourself up for missing adding a transaction and then give up on the process altogether.

Try your best to follow the system as diligently as possible, and you'll be better off than most who don't have a clear view of their finances.

Another practice I follow is regularly matching my actual bank account balance and the balance shown on the Wallet app.

If I've missed adding transactions, I can check my bank statement and add any missing transactions.

Or, if I can't figure out the missing transactions, I update the balance on the wallet app to match that of my bank account.

This helps me peek at my true bank balance whenever I open the Wallet app and be more mindful about spending further.

Start with the first simple step:

Record transactions for one day.

Once you get into the swing of things, you'll find it much easier to stick to.

Try it.

In-depth articles, series and guides

In-depth articles, series and guides